Our team takes a personalized approach to understanding your financial goals, risk tolerance, time horizon, and personal values. Through in-depth discussions, we gain insight into your unique circumstances to ensure your investment strategy aligns with your objectives. Based on this assessment, we carefully select a suitable benchmark for your broader portfolio, composed of broad-based market indexes. This benchmark serves as a reference point to measure your portfolio’s performance, providing transparency and a clear standard for evaluating investment success.

We construct portfolios rooted in the core principles of diversification, risk mitigation, cost efficiency, and tax optimization. Our process begins with forward-looking Long-Term Capital Market Assumptions (LTCMAs) provided by our trusted research partners, which project expected returns, risks, and correlations across asset classes. Using these assumptions, we optimize our diversified neutral benchmarks to maximize expected returns for each portfolio’s defined risk level. This disciplined approach ensures a balanced, efficient, and robust foundation tailored to your investment objectives while minimizing unnecessary costs and tax burdens.

The Walkner Condon Investment Committee may introduce discretionary tactical tilts to optimize portfolio weights for the following reasons:

These tilts are discretionary and tactical, meaning they are temporary adjustments to the long-term strategic allocation driven by the committee’s analysis of current market conditions. We select individual components (ETFs, Mutual Funds, Managed Accounts) to deploy the target strategy defined in previous steps.

Once the target strategy is defined, we meticulously select individual investment components to bring the portfolio to life. This includes a curated mix of Exchange-Traded Funds (ETFs), equities, bonds, managed accounts, and/or private investment funds chosen for their alignment with the optimized strategy. Our selection process emphasizes cost efficiency, liquidity, and performance potential, ensuring each component contributes to the overall objectives of diversification, risk management, liquidity, and tax efficiency while adhering to the strategic and tactical guidelines established in earlier steps.

We recognize that each client’s financial situation is unique, often involving legacy holdings, tax considerations, or specific requirements such as ethical investing preferences or concentrated positions. Our team collaborates closely with you to tailor our strategies to your circumstances, carefully navigating constraints like capital gains taxes or integrating existing investments into the broader portfolio. This bespoke approach ensures that your portfolio not only reflects our rigorous investment process but also accommodates your personal needs and goals.

We periodically rebalance portfolios to ensure continued alignment with our target allocation and with the latest investment committee recommendations. On an ongoing basis we track and report investment performance relative to each portfolio’s assigned benchmark.

Last updated: October 1, 2025 by Walkner Condon Investment Committee

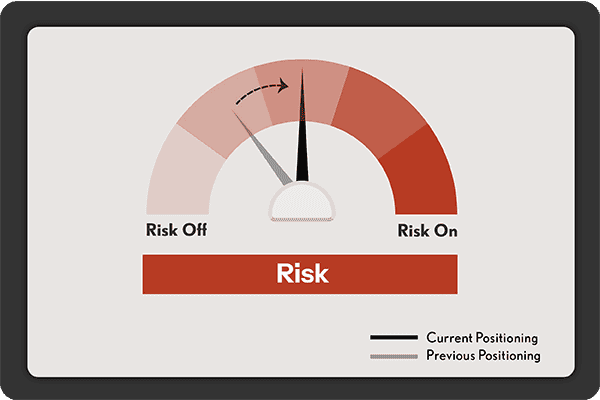

Risk

With ongoing economic uncertainties and potential geopolitical tensions, we adopt a neutral risk stance, leaning slightly more risk-off compared to last quarter due to heightened near-term volatility concerns.

Value vs. Growth

Growth stocks continue to show resilience, but valuations remain elevated. We view both value and growth as neutral, with neither significantly outperforming, as market dynamics balance momentum and fundamentals.

Regions

International equities remain fairly valued compared to U.S. stocks, which face higher valuations. Currency dynamics in our view may be less impactful this quarter, leading us to a neutral outlook on both U.S. and international markets.

Credit

With economic growth stabilizing but uncertainties lingering, we lean risk-on with credit, favoring opportunities in lower-quality bonds where yields compensate for manageable risks.

Duration

Given (relatively) steady inflation expectations and a stable monetary policy outlook, we maintain a neutral stance on duration, anticipating federal funds rates to remain largely unchanged.

Stocks vs. Bonds

We see stocks slightly favored over bonds, with U.S. equities showing modest upside potential despite elevated valuations. Bonds remain competitive, but in our view are slightly less attractive this quarter due to falling yields.

Equity Deviation Range

We typically maintain an equity allocation that is within +/- 5% of our strategic target. This allows for tactical adjustments in response to market opportunities or risks while ensuring that portfolios remain aligned with their long-term objectives.

Style and Factor Tilts

Within our equity allocations, we may take a more nuanced approach by incorporating specific style and factor tilts. This involves overweighting or underweighting certain investment styles (e.g., value, growth) or factors (e.g., momentum, quality) based on our market outlook and research.

Dynamic Fixed Income Allocation

We believe that fixed income allocations should not be static. Instead, we actively manage duration and credit exposure in response to changing market conditions. This may involve adjusting the maturity profile of our bond holdings or shifting between different sectors of the fixed income market.

Cost-Efficient Investments

While we prioritize cost-efficient investments across all asset classes and generally favor index funds, we try to allocate assets in a diversified manner and seek to maximize returns relative to risk.

Trading Frequency

We trade taxable portfolios with an eye on taxation, seeking to minimize capital gains. For all accounts, we design tolerance bands and rebalance portfolios when appropriate on a regular basis. Fund substitutions are made periodically after model changes are made.

The Investment Committee oversees and provides strategic guidance to ensure investment decisions align with Walkner Condon’s core principles and long-term asset allocation goals. It plays a critical role in upholding disciplined, principle-based investment practices.

Ready to take control of your financial future? Schedule an appointment to learn how our financial planning services can help you achieve your goals.

Book a Meeting