What is the S&P 500?

The S&P 500 is a commonly used benchmark when talking about investment performance and the economy, but what actually is it? The S&P 500 is a stock index comprised of 500 of the largest publicly traded companies in the United States. There is actually a committee that decides which companies are a part of the index based on a list of criteria including size, liquidity, profitability and geographic location (companies must be headquartered in the United States).

The S&P 500 was established in 1957 and, as of 2007, fewer than 90 of the original 500 companies are still in the index. Based on my research, there are 62 of the original companies still in the index today, a number that is difficult to determine due to the number of mergers and acquisitions over the years. The index is rebalanced each quarter and companies can be added to or removed from the index. According to Inc.com, in 1965 companies lasted an average of 33 years in the index, the average tenure dropped to 20 years by 1990, and is forecasted to drop to 14 years by 2026.

What is the Average Rate ofReturn of the S&P 500?

Over the last 25 years, the S&P 500 has an annualized return of 7.64%, including dividends. Over the entire history of the index, it has an annualized return of 10.48%. However, that doesn’t mean the index returns a consistent positive return every year. The best performing year was in 1958 when the index went up over 43% and the worst performing year was in 2008 when the index dropped by over 36%. In fact, from 2000-2010 the S&P returned a paltry .85% per year, which wasn’t even enough to keep up with inflation. From 2010-2020 the index experienced a 10 year bull run and returned an average of almost 14%!

Risk vs. Return

A lot of people get caught up in the idea of beating the S&P 500, but rarely is that actually what people want. People want peace of mind and the ability to take care of themselves and their family. They want to help their kids go to college, or take a big vacation, or retire comfortably without worrying about running out of money. Money can help to achieve those goals, but investment return in any given year is only part of the equation. What if you invested your kid’s college money in the S&P 500 and he/she graduated high school in 2008? Suddenly that college fund is looking a little lean. The market didn’t recover from the 2008 financial crisis until 5 years later in 2013. That college fund would be depleted before it would ever have the chance to rebound in value. That’s why time horizon (when you need the money) and risk capacity (how reliant you are on the money you’re investing) are such important factors when it comes to creating an investment plan.

Top 10 S&P 500 Companies From 2000: Where Are They Now?

In the year 2000, the top companies in the S&P 500 were heavily dominated by tech and telecom firms, as the dot-com bubble was near its peak. Here are the top 10 companies in terms of market capitalization at that time:

- General Electric (GE)

- Microsoft (MSFT)

- ExxonMobil (XOM)

- Cisco Systems (CSCO)

- Intel (INTC)

- Wal-Mart (WMT)

- Lucent Technologies (LU) – note: spinoff

- American International Group (AIG)

- International Business Machines (IBM)

- Citigroup (C)

Only one of these companies, Microsoft, is still in the top 10 today. One of these companies, Lucent Technologies, no longer exists. The remaining 8 companies hold various positions still in the S&P 500. General Electric peaked in 2000 and in 2024 was split into 3 separate companies that are all still listed in the S&P 500. Revenue and earnings per share were at an all time high for GE in 2000. Analysts rated the company a “strong buy” citing its growth potential, strong leadership, and market dominance. It’s easy to look back now and see in hindsight that investors were overconfident and the valuation was unsustainable. No one had a crystal ball that could show them the upcoming dot-com bubble burst or the 2008 financial crisis, both of which were major factors in GE’s decline.

Top 10 S&P 500 Companies in 2025: Where Were They 25 Years Ago?

- Apple Inc. (APPL) – added to the S&P 500 in 1982

- Microsoft Corp. (MSFT) – was #2 back in 2000!

- Nvidia Corp. (NVDA) – went public in 1999, added to S&P in 2001

- Amazon.com Inc. (AMZN) – went public in 1997, added in 2005

- Meta Platforms Inc. (META) – public in 2012, added in 2013; known as Facebook

- Alphabet Inc. Class A (GOOG) – public in 2004, added in 2006; known as Google

- Berkshire Hathaway Inc. (BRK.B) – Buffet took over in 1964, added in 2010

- Alphabet Inc. Class C (GOOG) – public in 2004, second share class added in 2014; known as Google

- Eli Lilly & Co. (LLY) – public in 1952, added in 1971

- Broadcom Inc. (AVGO) – public in 1998, Avago added in 2014, they acquired Broadcom in 2016

7 of the top 10 weren’t even part of the S&P in 2000! Google and Facebook weren’t even publicly traded until 2004 and 2012 respectively.

Recency Bias & All-Time Market Highs

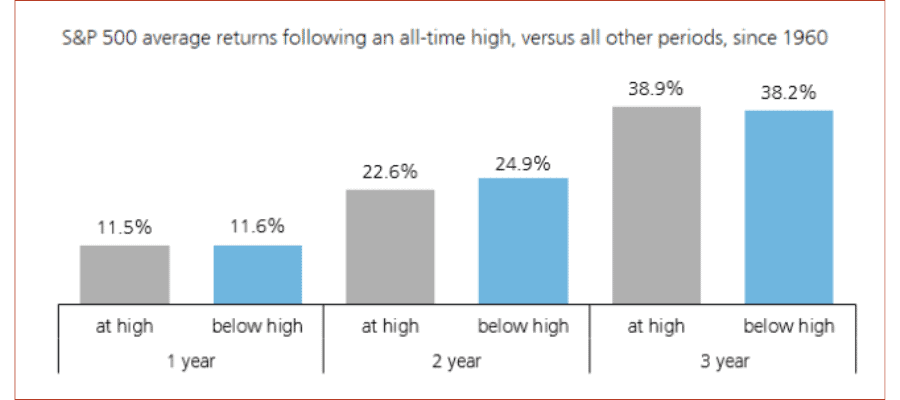

Recency bias causes people to think that what is happening now will continue to persist indefinitely. 25 years from now will Nvidia be the next Microsoft or the next Lucent Technologies? I found it amusing that when Nvidia was added to the S&P 500 it actually replaced Enron. My point isn’t that Nvidia is a bad investment, but that ultimately we don’t know what the future holds. We don’t know which companies will survive and thrive and which companies will be the next rising star or the next Enron. That’s one of the many reasons we diversify! Will there be another recession? Of course. Exactly when, what will cause it, how bad it will be, and how long it takes to recover from it are all unknowns. I’m also not suggesting that since the S&P is at an all time high you should wait to invest. In fact, the opposite is true. People have a lot of fear and hesitation about investing in the stock market when they think it’s overvalued, but data shows that returns following an all-time high have averaged similarly to the returns when the market is below its high.

Additionally, there are so many companies and investment opportunities outside of “the magnificent 7” and even outside of the S&P 500. There are around 6,000 publicly traded companies in the United States and U.S. equity markets only represent 42% of the total global equity market. Additionally, there is a massive private equity market ripe with companies who have yet to go public and are poised to be the next Nvidia or Google.

Looking for More 2025 Market Outlook Posts?

The companies that will dominate the headlines and make up the top 10 of the S&P 500 in 25 years are anyone’s guess. It is highly likely that some of these future leaders may not even be publicly traded today. We may also be surprised by who isn’t on that list 25 years from now. Recognizing our own biases is critical when it comes to investing. Psychology plays a significant role in financial decision-making, and no one is immune to its effects—not even me. A disciplined and diversified investment strategy, combined with a long-term perspective, can help mitigate the impact of emotional reactions to short-term market fluctuations. Additionally, equipping ourselves with knowledge by studying market history and analyzing data allows us to make informed, rational decisions. By focusing on long-term, data-driven strategies, we can better navigate the uncertainties of the market and avoid the pitfalls of emotional investing.

Key Takeaways

- The S&P 500 Evolves Constantly

Company turnover is high, with average tenure dropping to a forecasted 14 years by 2026. - Long-Term Returns are Strong

Despite short-term fluctuations, the S&P 500 has delivered 7.64% annualized returns over 25 years. - Market Leaders Change Over Time

Only Microsoft remains in the top 10 from 2000, highlighting the unpredictability of leadership.

- Diversification Reduces Risk

Opportunities beyond the S&P 500 are key to managing risks from market shifts. - Stay Disciplined and Long-Term Focused

Avoid emotional decisions by focusing on a diversified, data-driven strategy.